Most of people don’t understand how banks really work, they believe that banks have unlimited money and can lend unlimitedly. However, as resources are limited, banks have to lend the money assuming the minimum risk. The banker’s sentence «there are a lot of new villains out there younger than you» in the video refers to those better customers to lend to, in terms of risk.

Fintech and Neobanks

- What is FinTech?

Financial technology, FinTech for short, describes transformation and evolution of financial services and technology.

The term can refer to start-ups, technology companies or even legacy service providers.

It is increasingly difficult to know where technology ends and where financial services begin.

- Who’s doing this and what does a typical FinTech company look like?

When people think of FinTech, they often focus on startups, breaking into areas that banks and other legacy financial institutions have dominated. But we must think of all participants in a larger FinTech ecosystem:

- Well-established financial institutions such as Bank of America.

- Big tech companies such as Apple, Google, Facebook, and Twitter.

- Disruptors: fast-moving companies, often startups, focused on a particular innovative technology or process.

- What’s a neobank?

We can define neo-banks as an institution that provides some combination of checking accounts, savings accounts and debit cards via digital channels—primarily mobile—without any physical bank branches.

- How else do neobanks differ from traditional banks?

Financial analysts say neobanks stand out because of these features:

- Low cost structure

- Large ATM networks with no fees.

- No overdraft fees because the checking products are prepaid, reloadable debit cards.

- A simple and engaging mobile experience, unlike banking on a phone with a traditional bank.

- Intuitive budgeting and money-tracking tools.

- Real-time balances.

- What are the disadvantages of a neobank?

- If you need bank branch access, a neobank won’t be a good fit.

- If you’re paid in cash, a neobank isn’t likely your first choice, either. While there are options to deposit cash via Green Dot sites, as mentioned above, sometimes the sites charge a fee.

- Also, if you’re looking for a bank that will grow with you as your needs evolve, a neobank might not be the best choice. That is not to say neobanks themselves aren’t evolving, and this criticism might not be true within a few years.

- When you’re ready to buy a house, your neobank might be in the mortgage business, or when you inherit some money they might a wealth management product. However, they might not.

- What is the future of neobanks?

- Existing neobanks will likely expand into new product lines and look to become chartered banking institutions.

- Traditional banks will look likely for ways to tap this market with new sub-brands like Wells Fargo’s Greenhouse or Chase’s Finn.

- And fintech players in other lines will look to get into the deposit business.

The other variable is the global landscape. Neobanks are known as “challenger banks” in Europe, and several of them have their eyes set on the U.S. market but are looking for more clarity on how they might navigate the American banking system, which is fairly complex given the national chartering structure, the state chartering structure and the laws surrounding delivering services without branches.

As it stands now, many of those hurdles are enough to keep many on the other side of the Atlantic.

Resources:

https://relayto.com/pwc-financial/questions-and-answers-fintech-b0zaegbp

https://www.bankrate.com/banking/5-questions-to-ask-before-trying-a-neobank/

PSD2 Directive on Payment Methods

PSD2 is the European Directive that regulates payment services (for example transfers, direct debits or card payments) made in Europe, with the proposal to promote transparency, competition, and innovation of payment services in the financial sector . It also allows third companies to intervene in payments. This is what is known as «open banking».

The PSD2 regulates and harmonizes two types of services that already existed when the first PSD was adopted in 2007: payment initiation services (PIS) and account information services (AIS).

The AIS consists of collecting and specifying the information of the different bank accounts of a client in one place, while the PIS facilitate the use of online banking to make payments online.

Exposition of the mural with more detailed information:

Links:

https://www.triodos.es/es/que-es-psd2

https://www.bbva.com/es/lo-saber-la-psd2/

https://www.bbva.es/finanzas-vistazo/ef/banca-digital/psd2.html

Las mujeres y la auditoría de cuentas en la actualidad

Este artículo lo enfocaremos precisamente en la dificultad e impedimentos que se le presentan a las mujeres para llegar a altos puestos de trabajo, más concretamente a una profesión tan exigente como es la auditoría, que tradicionalmente ha estado casi en su plenitud formada por hombres, aunque en los últimos años la situación está cambiando y el número de mujeres en la profesión ha aumentado considerablemente. Abordaremos las evidentes mejoras en los resultados de la mujer frente al hombre en la auditoría de cuentas, y comentaremos los retos a los que se tendrá que enfrentar la mujer para hacer que esta situación cambie radicalmente.

Comenzaremos con un interesantísimo artículo escrito por Mercè Martí auditora de cuentas y presidenta de Kreston Iberaudit firma de auditoría de prestigio en España, Portugal y Andorra, además de ser miembro del consejo directivo del ICJCE. Adicionalmente es presidenta de la Comisión de Equidad de género del «Col·legi de Censors Jurats de Comptes de Catalunya” entre muchos otros galardones y cargos de importancia. Mercè es un claro ejemplo de la figura de la mujer dentro de cargos directivos en esta profesión, y demuestra que a pesar de ser madre de 3 hijos es posible compatibilizar sin ningún tipo de problema la vida familiar con el trabajo. Mercè comenta que aunque los niveles de formación universitaria entre mujeres están en records históricos. Cada año salen de las universidades más graduadas y las estructuras profesionales son cada vez más paritarias, los niveles de acceso de mujeres a la alta dirección es la gran asignatura pendiente y el sector de la auditoría no es una excepción.

En este artículo explica mediante un diálogo ficticio entre madre e hija las dificultades académicas y de género para poder llegar a ser auditora recorriendo el largo camino desde un grado universitario, máster, cursos, experiencia en auditoría y examen de aptitud… hasta el “techo de cristal” que sigue existiendo para la mujer. Su consejo es creer en ti misma, trabajar duro y demostrar. La demostración es lo único que llevará a generar confianza y a que el mercado y la sociedad vean, de una vez por todas, que la paridad no debe ser una postura estética, sino una estrategia necesaria, justa e inteligente en el largo plazo.

Los estudios lo demuestran, “los resultados del estudio muestran una mayor calidad de la información financiera en las auditorías firmadas por mujeres, al presentar estas menos devengos discrecionales o valores anormales que las firmadas por hombres”, comenta Diego Ravenda, coautor del estudio y profesor de Contabilidad y Análisis Financiero en la escuela de negocios TBS en Barcelona. Otro estudio publicado recientemente en Journal of Business Research, también comenta que las mujeres realizan este trabajo mejor que sus compañeros varones.

Los investigadores han identificado una posible justificación para sus resultados en estudios como el publicado en Journal of Economic Behaviour & Organization, que concluye que los hombres asumen entre un 28% y un 68% más riesgo que las mujeres. Un segundo estudio publicado en Accounting Horizons, sugirió que los hombres sufren de exceso de confianza en un mayor número de casos. Estas características psicológicas podrán determinar el juicio de los auditores y por lo tanto la calidad de su trabajo, comenta el profesor de TBS Diego Ravenda: “La contabilidad debe ser conservadora, prudente. Si hay más prudencia, es decir, se realiza una verificación mayor de las cuentas, se evita su inflación y por lo tanto estas son de mayor calidad”. El estudio, que ha determinado un efecto de género en la calidad de los servicios de auditoría, presenta un análisis de más de 90 empresas españolas cotizadas en bolsa durante un periodo de ocho años.

Las auditorías firmadas por mujeres se han triplicado durante los últimos doce años en España. Además de que haya aumentado el número de mujeres dedicadas a los servicios de auditoría. Aun así, a 31 de marzo de 2019 sigue siendo el total de auditores ejercientes y no ejercientes en España de 21.335 correspondiendo 5.465 a mujeres, o lo que es lo mismo un 25,615% de mujeres. Por lo que sigue existiendo una gran disparidad en el número de auditores vs auditoras en nuestro país, no se trata de entrar en valoraciones ni eficiencias de unos y otros. Ni mejores, ni peores. Pero sobre todo el reto que hay que seguir luchando por conseguir es el de reivindicar a las mujeres en la gestión y dirección de las firmas y conseguir así poder estar en igualdad con los hombres.

Bibliografía

- https://www.mercemarti.com/es/merce-marti/

- http://auditoria-auditores.com/articulos/articulo-auditoria-mam-quiero-ser-auditora-/

- https://www.tbs-education.es/es/profesor-de-tbs-las-auditorias-firmadas-por-mujeres-son-mejores

- http://auditoria-auditores.com/articulos/articulo-auditoria-ni-m-s-ni-menos-simplemente-iguales/

- http://www.icac.meh.es/Documentos/INFORMES/01.Situaci%C3%B3n%20de%20la%20Auditor%C3%ADa%20en%20Espa%C3%B1a/08.A%C3%B1o%202018.pdf

Artículos científicos de referencia:

- Garcia-Blandon, J.; Argilés-Bosch, J.; Ravenda, D.: “Is there a gender effect on the quality of audit services?”, Journal of Business Research, Volume 96, March 2019, Pages 238-249.

- Charness, G; Gneezy, U.: “Strong Evidence for Gender Differences in Risk Taking”, Journal of Economic Behavior & Organization, Volume 83, Issue 1, June 2012, Pages 50-58.

- Ittonen, K.; Vähämaa, E.; Vähämaa, S.: “Female Auditors and Accruals Quality”, Accounting Horizons, June 2013, Vol. 27, No. 2, pp. 205-228.

Editor: Josué Pérez García

Banking and Big Data

Big Data is a set of high volume, high speed and / or high variety data that requires new forms of processing to improve decision making processes, research and process optimization. Its appearance in the 2000’s is explained by the fact that this set of data was difficult or impossible to process using traditional methods. Doug Laney (industry analyst) articulated the definition of Big Data as de three V’s:

- Volume: It refers to the extreme volumen of data that organizations must process.

- Velocity: There is a growing need to deal with these data torrents in near real time.

- Variety: Data comes in a wide variety of types. From structured (for instance,the numeric one) to unestructured (such as videos and text documents).

The importance of Big Data lies in the fact that with it you can take data from any source and analyse it to find answers that enable costs and time reduction, optimization and smart decision making.

About the relationship between Big Data and banks, it is important to know that the banking sector is one of the business domains that makes the highest investment in Big Data. Thanks to this relationship banks gets the data and from all the information contain, take out the useful and profitable information. In summary, Big Data has helped the banks in the following aspects:

- Personalized customer experience, where the bank uses Big Data to know their users and find new ways to cater to them.

- User segmentation and product targeting: by using Big Data, you can better understand your customer’s needs and also to pinpoint problems in your product targeting.

- Business process optimization and automatization.

- Improved cybersecurity and risk management by identifying fraud or preventing terrorist activities.

- Better employee performance and management.

Links:

The Guarantee Fund for Deposits of Credit Institutions

This video pretends to clarify what the Guarantee Fund for Deposits of Credit Institutions is. We structured it in four main parts: the first one consists in a short introduction where we explain the most important aspects of this spanish entity. In the second one, we talk about how it works in other countries: Central Africa countries, Korea (both North and South Korea) and the United States. We left the European Deposit Insurance Scheme for the third part, where we introduce this plan and how it will help banks in the euro area.

We decided to end up this video with some conclusions, where we show our concern about the DGF, the current situation of Spain’s economy and its effects in the market, since we are facing an economic slowdown.

Facebook says Libra could use a series of cryptocurrencies pegged to different currencies

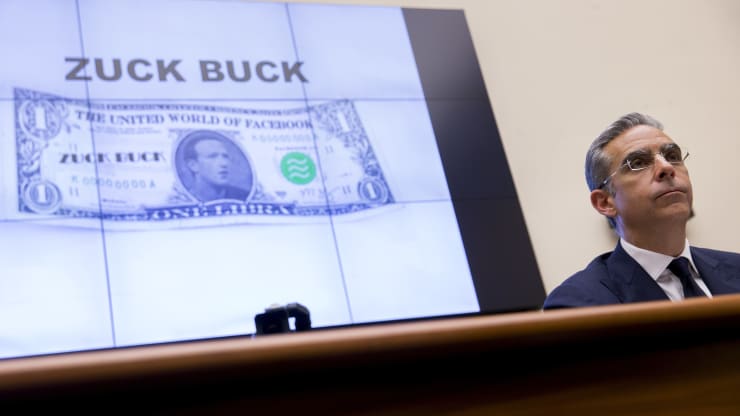

A “Zuck Buck” is displayed on a monitor as David Marcus, the executive leading Facebook’s blockchain initiative, is questioned by U.S. lawmakers in Washington, D.C., on July 17, 2019.

Date: October, 21st 2019

Media: CNBC

What happened?

Facebook has suggested its Libra project could use multiple cryptocurrencies backed by different existing currencies like the dollar, rather than having one single digital token tied to a basket of currencies. Instead of having a synthetic unit they are using a series of stablecoins, a dollar stablecoin, a euro stablecoin, a sterling pound stablecoin, etc. These currencies are focused on reducing the volatility observed in virtual currencies such as bitcoin and others. With this project they want to create a more efficient cross-border payment system.

Whom and where it affects?

It would affect the whole world, specially most developed countries where most of people have access to internet, it will also affect the international banking and financial system. Although People still aren’t very familiar with this cryptocurrencies, they are gaining popularity and it’s a reality they will become more important with time.

What sort of public or private institutions are involved?

The Association libra, the hand that guides the nascent cryptocurrency, is composed of partner companies. The Libra Association will be an independent non-profit organization based in Geneva, Switzerland. Its aim is to coordinate and provide a framework for governance on the Libra network and to reserve and guide grants of social impact in support of financial inclusion. The association is constituted from the net of nodes validators that manage the blockchain Libra. Its members will consist of geographically distributed and diversified enterprises, non-profit and multilateral organisations and academic institutions.

Why is it important for Banking and Finance?

It is important because basically this new system will be backed up by different existing currencies so only for that reason it will affect traditional banking and change it in the way people percieve money, this change has already began with other cryptocurrencies that exist already, so every time people fear less to this new concept of money and for sure its going to be the future of our finances.

What do you think will be the consequences in the foreseeable future?

The advantages of this type of money is that is an excellent alternative for many people who have to send money. Apart from being a currency with a limitation in its issuance, they allow that before the increase in its demand its price has risen and therefore becoming an excellent investment. It is also a technology that allows you to create automatic rules to money. All these great advantages allow us to predict that its use will continue to grow.

We can see many transactions that are made, new very powerful players that are entering, new projects that are emerging, after all, it is our day to day, and all these are very strong indicators that we are on the right track.

Today may not be the best system in all situations, but it is certainly an unstoppable evolution. The spread of bitcoins in the world as a global currency is already a reality, the development of solutions that solve some gaps is already underway, the revolution that the blockchain has brought and is also bringing to other sectors, beyond the systems of payment, is constantly increasing.

All the largest companies have already realized the value of that technology and are focusing on solutions to implement them in their businesses.

Key words:

Cryptocurencye, Blokchain, Stablecoins, Bitcoin and Volatility.

Long-term negative rates have ‘adverse consequences’ we don’t fully understand, says Jamie Dimon

Above, Jamie Dimon

(Diane Bondareff / Invision for JP Morgan Chase)

Link: Long-term negative rates have ‘adverse consequences’ we don’t fully understand, says Jamie Dimon

Date: 21st October 2019

Media: CNBC

What happened?

The article talks about various topics, which, of course, are all intertwined. First and foremost we have to mention that the rate at which the economy is growing is slowing down, this is caused by various geopolitical factors, such as the Brexit deal and the U.S.-China trade war. This, in turn, is the main reason why the interest rates are at an all-time low, reaching, in some places, numbers below zero.

Whom and where does it affect?

As one might imagine, the decrease in interest rates has an effect on every participant in our global economy. For example, when interest rates are low, people tend to spend more because investing in financial products generates next to no returns, they also tend to take out more loans to invest in different business venues since loans become «cheaper». Obviously those living in countries where the rates of interest are close to or below zero will be affected the most.

What sort of public or private institutions are involved?

The following public institutions:

- National Central Banks (NCB)

- European Central Bank (ECB)

- International Monetary Fund (IMF)

The following private institutions:

- Private banks, such as J.P. Morgan Chase

Why is it important for Banking and Finance?

Negative interest rates change the normal way of how banking is done. Having negative interest rates, essentially means that deposits will incur a charge instead of receiving interest. i.e. you will have to pay to have your money in a bank instead of being paid for having said deposit.

What will the consequences be in the foreseeable future?

The consequences will depend on the future development of the interest rates and decision-making of central banks. There are two possible outcomes:

- The continuous drop in interest rates below zero. This outcome would cause a fall in the consumption of financial products, even a cash withdrawal if banks started to charge for having a bank deposit. On the other side, people would be even more tempted to take out loans and invest in businesses.

- The rise in interest rates, resurfacing above zero. This would, probably, end in a massive slowdown of the economy, or even, a recession.

Key words:

ECB, Bank of Japan, negative interest rates, recession, slowdown, European Union, United States, Jamie Dimon

Interest rate rot hits regular-saver accounts

Banks have continued trimming the top rates available to savers

Link: Interest rate rot hits regular-saver accounts

Author: Sam Baker

Date: 14th October 2019 / 5:30pm

Media: The Telegraph (UK)

What happened?

British banks are lowering interest rates on the top regular-saver accounts, due to financial problems arising from the country’s political and economic situation (Brexit). Consumers are affected because banks only benefit those accounts that have monthly cash income.

Whom and where it affects?

The protagonists of this news are the private banking and consumers. The news is located in the United Kingdom.

What sort of public or private institutions are involved?

The public institution involved in this news is the Bank of England. There are private banks that also appears in the news such us: M&S Bank, HSBC, First Direct, Nationwide, and Virgin Money.

Why is it important for Banking and Finance?

This news is very important for Banking and Finance, because it reflects how the concept of “savings account” is losing its meaning. If rate cuts continued: where is the consumers’ savings? If this trend continues, we would end up paying interest rates for maintaining a savings account.

What do you think will be the consequences in the foreseeable future?

The imminent Brexit as well as a possible global crisis are factors that can lead to zero (or even negative) interest rates. With this low interest rate policy, savers will lose: they will see how their deposits will barely be remunerated, in cases of companies, banks will start charging their large clients for saving their money. This is something that is already happening throughout the European Union. On the other hand, low interest rates will benefit debtors, as it allows them to pay less for their debts. In addition, the new loans will be cheaper.

Key words:

Regular-saver accounts, Brexit, consumers, banks, cash income, private banking, the Bank of England, savings account, rate cuts, trend, zero interest rates, low interest rate policy, deposits, debtors, loans.

Banks expect to cut business lending at fastest rate since 2008 crash

Link: Banks expect to cut business lending at fastest rate since 2008 crash

Date: 17th October 2019

Media: The Guardian

What happened?

The bank of England made a survey which shows that banks plan to reduce the rating in response to rising defaults and a fall in demand.

Whom and where it affects?

It affects banks and individuals. Banks have seen the biggest collapse in demand from commercial property companies. On the other hand, individuals are expected to find it more difficult to get credit over the next three months as banks and building societies cut the length of interest-free period on new credit card lending.

Apart from the reasons just explained, british businesses will be affected because of Brexit, a phenomenon that is growing in the United Kingdom.

What sort of public or private institutions are involved?

The first involved is the Bank of England because they made the survey. Second, the banking sector because it is the one that is going to cut its lending to businesses. Finally, the lenders, who were asked to answer several questions in order to have this survey made.

Why is it important for Banking and Finance?

It is important for banking and finance because the finance industry, as the figures revealed, shows an increasing caution across it. With money so cheap, there is a lot of debt out there and the worry is that for some people it is starting to be reflected in their daily life.

What do you think will be the consequences in the foreseeable future?

As a consequence, we can say that default rates are going to increase slightly which may lead to bankruptcy. This will affect not only the United Kingdom but will also spread to Europe and, in a long term, the rest of the world. Not to say that the first affected will be the citizens, who are going to have financial problems with their repayments.

Key words:

Default, bankruptcy, loan, debt, lenders, mortgage, Bank of England