It is model or a way of banking that embraces environmentally and socially conscious practices. While “traditional” banks try to earn profits, the ethical banks try to do it in a way consistent with their principles and values, such as participation, transparency, coherence, implication…

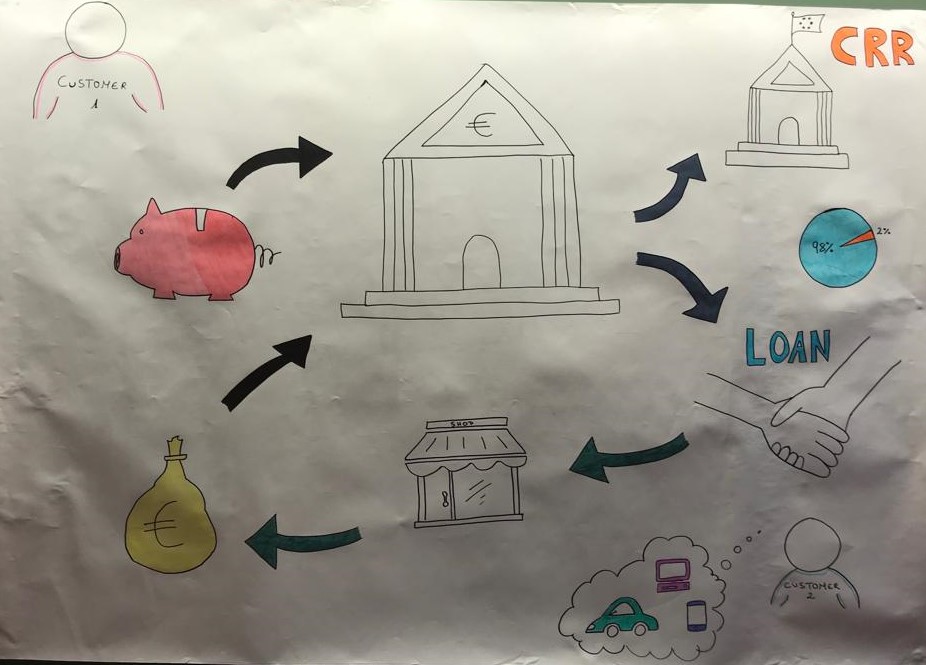

An ethical bank invests in projects that aim to earn a healthy profit and to make a positive difference in society. It finances those businesses with their depositors and investors’ money. So, the money that those people save is invested back into the society they are living in.At any time, customers know what the bank does with their money (transparency).

The supported projects of each organization to whom they lend money for, are published in the bank website. By lending exclusively to those organizations that put people and planet before profits, the savers’ money contributes to create a positive impact and real returns (real economy).This type of banking makes the difference because it only invests in things which are good for both people and the planet. Things like renewable energy, organic farming and ecological development. In addition, it offers the possibility of being able to share part of the interests generated with different social, cultural and environmental organizations. On the other hand, they do not offer services that include alcohol, gambling products, pornography, tobacco and weapons.

Example: “For self-employed copywriter Kate Duggan and her partner Rick, ethical banking was a natural consideration when deciding where to save their money.

Having once worked at an ethical bank herself, Duggan was well aware of the growing awareness of responsible investing. This is when savers put money in funds or accounts that support social and environmental programs that aim to bring about a positive change.”

Source: https://inews.co.uk/inews-lifestyle/money/ethical-investing-savings-make-positive-difference/

Video: https://www.youtube.com/watch?v=VRP5E0EF8kc