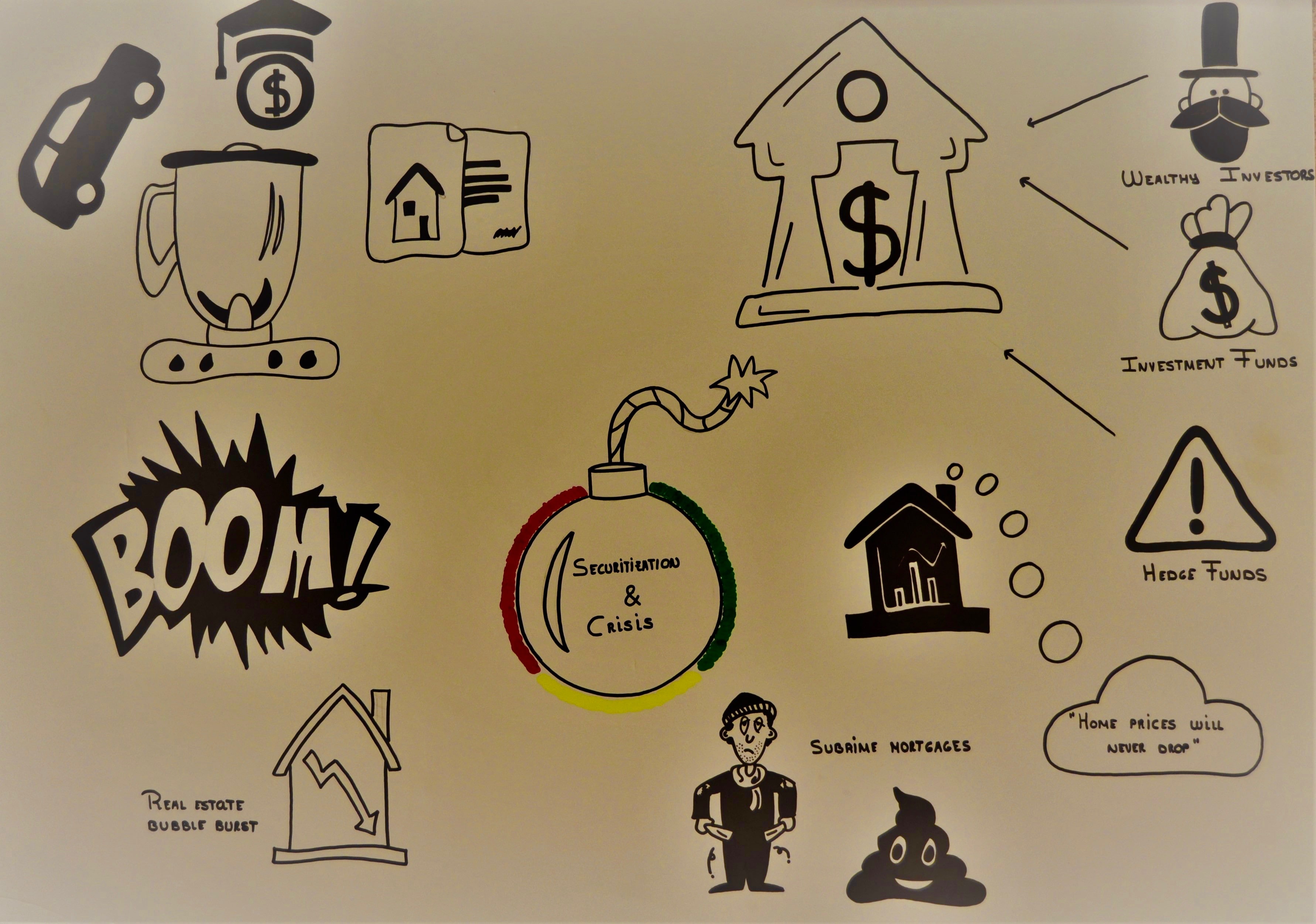

Securitization is a procedure whereby a financial institution creates a package of different assets, such as loans and credits, and then sells it. Thanks to this operation the issuer receives immediate cash and reduces the risk of its business by transmitting part of it to the investor. The buyer receives a profit in form of regular payments throughout the life of the instrument and also the amount lent at the end.

Securitization instruments played a vital role as one of the triggers of the 2008 financial crisis due to its importance in the credit crisis that affected the United States financial system. During the early 2000s, investment banks increased the commercialization of securitization titles backed with mortgage loans such as MBSs and CDOs. There was a huge demand boosted by low-interest rate conditions and the illusion that the real estate market was solid rock. Then banks started to bundle high-risk mortgages, also known as subprime, into those assets. As debtors began to fail their payments after the real estate bubble burst, and investors realized that the titles were full of toxic mortgages, the market for those products deteriorated and some specialized institutions went bankrupt. The bottom line was the loss of trust among market’s agents and the subsequent credit crisis that later passed on to other economies and ended up, after several mutations, being a central cause of the 2008 financial crisis.