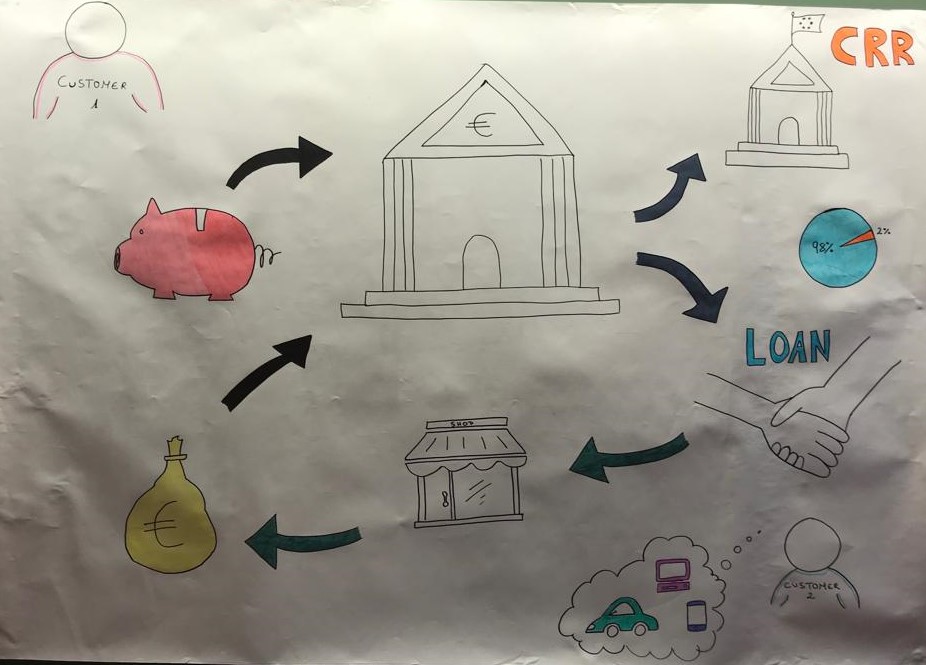

Banks have the obligation to keep in reserve only a part of their customers’ deposits, in a percentage that depends on the requirements of the Central Bank (the reserve requirement, 2% in Spain). When banks lend the part of the deposits that are not in reserves, the money can return to the banking system in the form of a new deposit. That repetition of loans can happen several times. Banks «multiply» money by creating bank money.

The reserve requirement is a central bank regulation that establishes the minimum amount of reserves that a commercial bank must have.

The money multiplier is the process that allows banks to multiply the bank money by starting from an initial amount of money. This is because banks are only obliged to keep in their reserves a minimum level of money (The Cash Reserve Ratio, CRR)

With this process of creation of bank money, the money supply of a country is

increased. In most modern economies most of the money supply is in the form of bank money and not legal money (notes and coins).

Example: ‘‘The standard story about how banks create money, and how reserves work, is the ‘Money Multiplier Model’. Money creation starts with the government injecting ‘fiat money’ into the economy – say by giving a welfare recipient $100 in cash. That recipient then deposits the cash in a bank, which hangs on to a government-mandated fraction of it (the ‘Reserve Requirement’) – say 10 per cent or $10 – and lends out the rest to a borrower. The borrower then deposits that $90 in another bank, which does the same thing – hangs onto 10 per cent of the $90 or $9, and lends out another $81 to another borrower.’’

Links:

News about the money multiplier

Videos:

Monetary policy, money creation in a fractional reserve banking system.